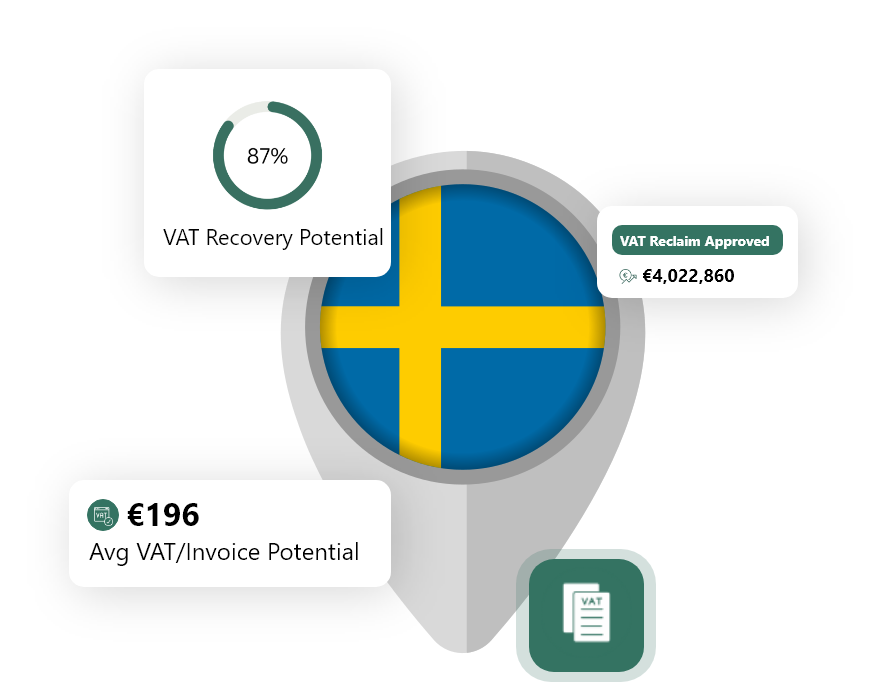

Foreign VAT Refunds Guide from Sweden

The following information details the requirements needed to be eligible for a VAT refund in Sweden. These include claimable expense types, the Sweden VAT rates and deadlines, as well as claiming periods.

What Expenses are Claimable for VAT Refund in Sweden?

What are the Sweden VAT Rates?

Sweden divides VAT rates into the following three categories:

Applies to all goods and services.

• VAT rate 12% applies to certain goods and services, such as food, hotel accommodation, and some cultural events.

• Additionally, some goods and services are subject to a reduced VAT rate of 6%, such as books, newspapers, and public transportation.

Applies to certain goods and services, such as exports and intra-community supplies of goods.

How to Get VAT Refunds from Sweden for Your Business?

VAT Refunds Guide for EU Companies

- Register for VAT in your home country

- Provide evidence of your VAT registration to the Swedish tax authorities (Skatteverket)

- Submit a VAT refund claim to the Skatteverket

- Include all required documentation, such as original invoices and receipts

- Wait for the Skatteverket to process your claim and issue a refund

VAT Refunds Guide for Non-EU Companies

- Non-EU businesses must appoint a fiscal representative in Sweden to handle their VAT refund claims

- Register for VAT in Sweden through your fiscal representative

- Provide evidence of your VAT registration to the Skatteverket

- Submit a VAT refund claim to the Skatteverket through your fiscal representative

- Include all required documentation, such as original invoices and receipts

- Wait for the Skatteverket to process your claim and issue a refund

Frequently Asked Questions About Sweden VAT Recovery

June 30 annually, within six months of the conclusion calendar year in which the tax was incurred.

All countries.

January-December of the previous year.

It can take up to 3 months for EU businesses and 6 months for Non-EU businesses to get a VAT refund to be processed by the Sweden Tax Authority depending on complexity of the claim.

Need Help with Your VAT Refund from Sweden?

We have helped companies reclaim €200+ M in VAT refunds over the last eight years. Our expertise and technology allow us to process your refund quickly and automatically.