Foreign VAT Refunds Guide from Luxembourg

The following information details the requirements needed to be eligible for a VAT refund in Luxembourg. These include claimable expense types, the Luxembourg VAT rates and deadlines, as well as claiming periods.

What Expenses are Claimable for VAT Refund in Luxembourg?

Hotel & Accommodation

0

%

Restaurants

0

%

Conf, Trade Shows & Expo

10

%

Public Transport

0

%

Fuel

10

%

Marketing Costs

10

%

Professional Fees

10

%

Car Rental

10

%

Training, Courses & Seminar

10

%

What are the Luxembourg VAT Rates?

The VAT rates in Luxembourg are as follows:

Applies to mostly all goods and services.

• The reduced VAT rate of 8% applies to certain goods and services, such as food and non-alcoholic beverages, pharmaceuticals, and certain cultural services.

• The reduced VAT rate of 3% applies to certain goods and services, such as books, newspapers, and e-books.

• Luxembourg does not have a zero VAT rate.

How to Get VAT Refunds from Luxembourg for Your Business?

VAT Refunds Guide for EU Companies

- Ensure that you meet the conditions for claiming a VAT refund in Luxembourg, including not having a place of business or fixed establishment in Luxembourg, not being registered for VAT in Luxembourg, and having incurred VAT in Luxembourg on goods and services that are used for your taxable business activities in your home country.

- Submit an electronic refund application via the VAT refund portal of your home country by September 30th of the year following the refund period.

- Provide all necessary information and supporting documentation, including invoices and other relevant documents, to the tax authorities in your home country.

- Wait for the tax authorities in Luxembourg to process your refund application and transfer the refunded amount to your bank account.

VAT Refunds Guide for Non-EU Companies

- Ensure that you meet the conditions for claiming a VAT refund in Luxembourg, including not having a place of business or fixed establishment in Luxembourg, not being registered for VAT in Luxembourg, and having incurred VAT in Luxembourg on goods and services that are used for your taxable business activities outside of the EU.

- Submit a paper refund application to the Luxembourg tax authorities by June 30th of the year following the refund period.

- Provide all necessary information and supporting documentation, including invoices and other relevant documents, to the Luxembourg tax authorities.

- Wait for the Luxembourg tax authorities to process your refund application and transfer the refunded amount to your bank account.

Frequently Asked Questions About Luxembourg VAT Recovery

June 30 annually, within six months of the conclusion calendar year in which the tax was incurred.

January-December of the previous year.

It can take up to 6 months for EU businesses and 10 months for Non-EU businesses to get a VAT refund to be processed by the Luxembourg Tax Authority depending on complexity of the claim.

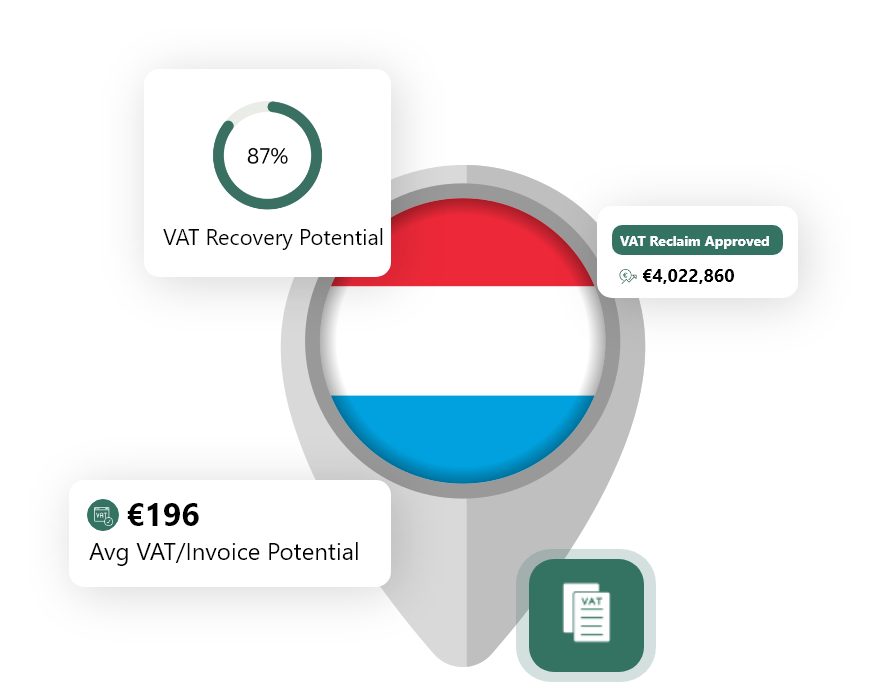

Need Help with Your VAT Refund from Luxembourg?

We have helped companies reclaim €200+ M in VAT refunds over the last eight years. Our expertise and technology allow us to process your refund quickly and automatically.