Foreign VAT Refunds Guide from Taiwan

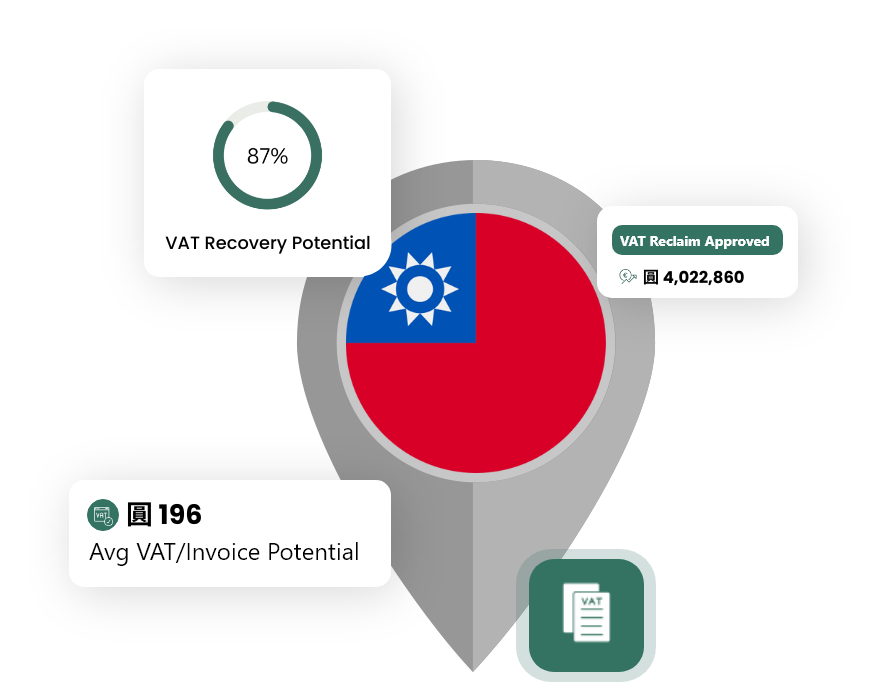

The following information details the requirements needed to be eligible for a VAT refund in Taiwan. These include claimable expense types, the Taiwan VAT rates and deadlines, as well as claiming periods.

What Expenses are Claimable for VAT Refund in Taiwan?

What are the Taiwan VAT Rates?

The VAT (Value Added Tax) rate in Taiwan is:

The standard VAT rate in Taiwan, applied to most goods and services.

Please note that VAT rates may change, and their applicability depends on the specific goods or services. It's always best to consult an official source or tax professionals for the most up-to-date information.

How to Get VAT Refunds from the Taiwan for Your Business?

From the information found, it appears that the process for obtaining VAT refunds from Taiwan for businesses is not explicitly outlined on public platforms. Furthermore, it’s important to note that several sources suggest that Taiwan imposes a business tax, which consists of VAT and GBRT.

However, the Taiwan Ministry of Finance has published a release clarifying the eligibility for VAT refund, but the specifics are not provided in the search result snippet.

Given the lack of publicly available specifics, it is highly recommended for businesses seeking to obtain VAT refunds in Taiwan to consult with a tax professional or directly reach out to the Taiwan Tax Administration for the most accurate procedures and eligibility criteria.

Frequently Asked Questions About Taiwan VAT Recovery

June 30 for all countries.

Specific countries – Australia, Austria, Bahrain, Belgium, Finland, France, Germany, Hong Kong, Ireland, Israel, Kuwait, Liechtenstein, Macao, Netherlands, Qatar, Saudi Arabia, Slovenia, Switzerland and the United Kingdom.

January-December of the previous year.

It can take up to 9 months depending on complexity of the VAT claim.

Need Help with Your VAT Refund from Taiwan?

We have helped companies reclaim €200+ M in VAT refunds over the last eight years. Our expertise and technology allow us to process your refund quickly and automatically.