Foreign VAT Refunds Guide from Germany

The following information details the requirements needed to be eligible for a VAT refund in Germany. These include claimable expense types, the Germany VAT rates and deadlines, as well as claiming periods.

What Expenses are Claimable for VAT Refund in Germany?

What are the Germany VAT Rates?

Germany divides VAT rates into four categories:

The standard rate, applied to most goods and services.

There is a reduced rate of 7% that applies to certain goods and services, such as specific food items, books, and public transportation.

Some specific goods and services, like exports and intra-community supplies, are subject to a 0% VAT rate.

There are also certain goods and services that are completely exempt from VAT, such as health services and financial services.

How to Get VAT Refunds from the Germany for Your Business?

VAT Refunds Guide for EU Companies

VAT Refunds Guide for EU Companies

- Check Eligibility: The company should be established in the EU, but not in Germany.

- Gather Documentation: Compile all necessary invoices and documentation relating to VAT.

- Submit Application for Refund: You need to file your electronic application through the online portal of your home country's tax authorities. Your respective national tax authority will transfer your application to the German Federal Central Tax Office.

- Await Processing: The German Federal Central Tax Office will handle the VAT refund process.

VAT Refunds Guide for Non-EU Companies

- Check Eligibility: Companies must be based outside the EU without VAT registration in Germany.

- Gather Documentation: Gather necessary original invoices and documentation to support your VAT claim.

- Submit Application for Refund: Submit a written application for refund to the German Federal Central Tax Office. The application must be in German and must include the required documentation.

- Await Processing: Wait for the German Federal Central Tax Office to process your VAT refund.

Frequently Asked Questions About Germany VAT Recovery

September 30 for all EU countries and Jun 30 for Non-EU countries.

All EU countries and Non EU-Countries such as Andorra, Antigua, Barbuda, Australia, Bahamas, Bahrain, Bermudas, British Virgin Islands, Brunei Darussalam, Bosnia & Herzegovina, Canada, Cayman Islands, China(Taiwan), Gibraltar, Greenland, Grenada, Guernsey, Hong Kong, Iceland, Iran, Iraq, Israel, Jamaica, Japan, Jersey, Korea (People?s Rep), Korea(ROK), Kuwait, Lebanon, Liberia, Libya, Liechtenstein, Macao, Maldives, Marshal Islands, Macedonia, Norway, New Zealand, Oman, Qatar, Pakistan, St Vincent, San Marino, Saudi Arabia, Serbia, Solomon Islands, Swaziland, Switzerland, United Arab Emirates, the United Kingdom, United States of America, Vatican City.

January-December of the previous year.

It can take up to 6 months for EU companies and 10 months for Non-EU companies depending on complexity of the VAT claim.

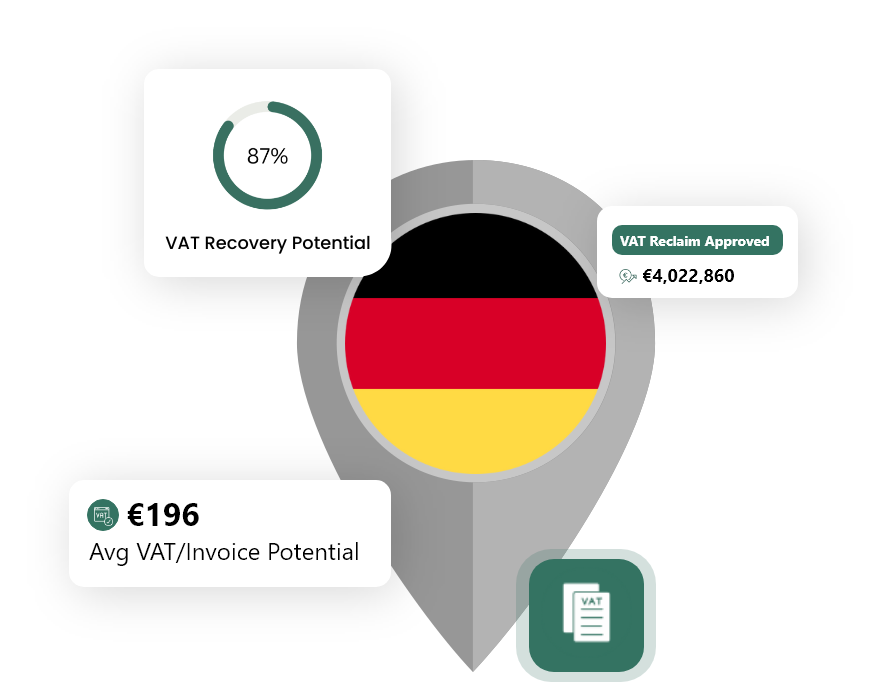

Need Help with Your VAT Refund from Germany?

We have helped companies reclaim €200+ M in VAT refunds over the last eight years. Our expertise and technology allow us to process your refund quickly and automatically.