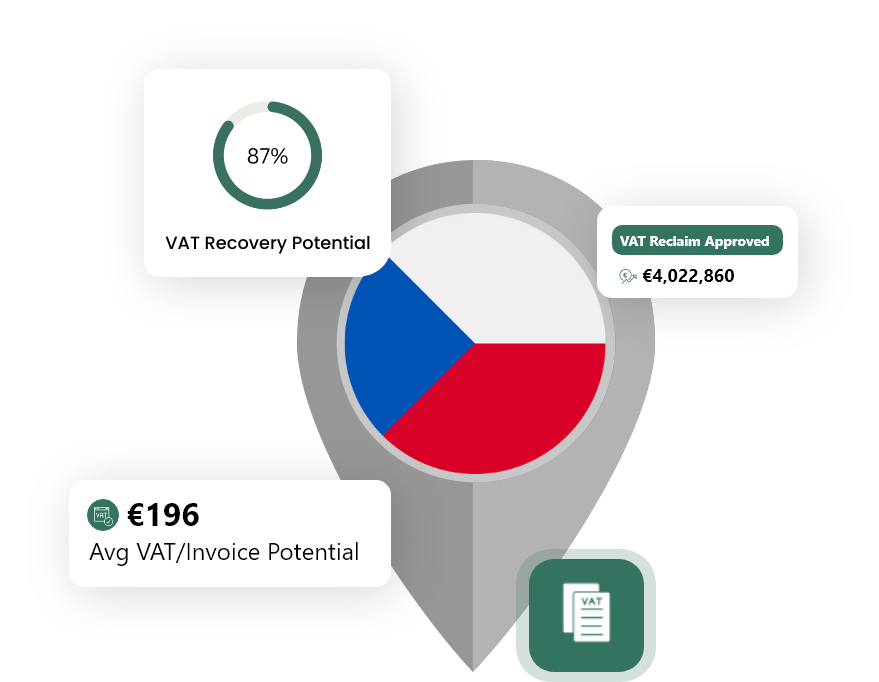

Foreign VAT Refunds Guide from Czech Republic

The following information details the requirements needed to be eligible for a VAT refund in Czech Republic. These include claimable expense types, the Czech Republic VAT rates and deadlines, as well as claiming periods.

What Expenses are Claimable for VAT Refund in Czech Republic?

Hotel & Accommodation

0

%

Restaurants

0

%

Conf, Trade Shows & Expo

0

%

Public Transport

0

%

Fuel

0

%

Marketing Costs

10

%

Professional Fees

10

%

Car Rental

0

%

Training, Courses & Seminar

10

%

What are the Czech Republic VAT Rates?

The VAT (Value Added Tax) rates in the Czech Republic are as follows:

Applies to all goods and services.

There are two reduced VAT rates in the Czech Republic. One is set at 15%, and a second reduced rate is 10%.

How to Get VAT Refunds from Czech Republic for Your Business?

VAT Refunds Guide for EU Companies

- Complete online application: Submit the refund application electronically via the portal of your home Member State.

- Deadlines: Applications must be submitted before October 1st of the calendar year following the refund period.

- Documentation: Include original invoices and import documents.

- Minimum claim: Claims must be at least CZK 1,000 for a period of less than a calendar year but at least three months, or at least CZK 250 for a calendar year or the remainder of a calendar year.

VAT Refunds Guide for Non-EU Companies

- Appoint a tax representative: For this process, normally a tax representative that resides in Czech Republic must be appointed.

- Submit a paper application: The application must be submitted to the Czech Tax Authority (Finanční ředitelství) by June 30th following the year in which the VAT was paid.

- Documentation: Include original invoices and import documents.

- Minimum claim: Claims must be at least CZK 5,000 for a period of less than a calendar year but at least three months, or at least CZK 1,500 for a calendar year or the remainder of a calendar year.

- The exact process and conditions may vary, and the above is meant as a general guide. Always consult with a tax professional or directly with local tax authority for specific advice and up-to-date information.

Frequently Asked Questions About Czech Republic VAT Recovery

September 30 for all EU countries and Jun 30 for all Non-EU countries.

All EU countries and the United Kingdom.

January-December of the previous year.

It can take up to 6 months depending on complexity of the claim.

Need Help with Your VAT Refund from Czech Republic?

We have helped companies reclaim €200+ M in VAT refunds over the last eight years. Our expertise and technology allow us to process your refund quickly and automatically.