Foreign VAT Refunds Guide from Cyprus

The following information details the requirements needed to be eligible for a VAT refund in Cyprus. These include claimable expense types, the Cyprus VAT rates and deadlines, as well as claiming periods.

What Expenses are Claimable for VAT Refund in Cyprus?

What are the Cyprus VAT Rates?

The VAT (Value Added Tax) rates in Cyprus are divided into several categories:

The standard rate that applies to most goods and services.

A 9% rate applied to certain kinds of services and a 5% rate applied to specific goods and services.

Some goods and services are subject to a 0% VAT rate.

Lastly, there are goods and services that are entirely exempted from the VAT.

How to Get VAT Refunds from Cyprus for Your Business?

VAT Refunds Guide for EU Companies

- Check Eligibility: Businesses must be operating within the EU and cannot be based in Cyprus.

- Gather Documentation: Prepare all original invoices and documentation related to VAT.

- Submit Application for Refund: The refund claim should be filed online via the authorities in the country where your business is based. The authorities will then pass on your claim to the Cypriot authorities.

- Wait for Processing: After submitting your application, wait for the VAT refund process to be completed by the Cypriot authorities.

VAT Refunds Guide for Non-EU Companies

- Check Eligibility: Businesses must be operating outside the EU and cannot be based in Cyprus.

- Gather Documentation: Similar to EU businesses, you need to prepare all original invoices and documentation to support the VAT claim.

- Submit Application for Refund: An application with the details of the claimant, a summary of the refund request, and details of each invoice related to the VAT refund application should be sent to the authorities where the VAT was incurred.

- Wait for Processing: Wait for the VAT refund process completed by the Cypriot authorities.

Frequently Asked Questions About Cyprus VAT Recovery

December 30 for EU countries and September 30 for Non-EU countries.

Switzerland and Israel.

For companies established within the EU (inclusive of Canary Islands and Monaco), the relevant timeframe is from January to December of the prior year. Conversely, for businesses located outside of the EU (excluding Canary Islands and Monaco), the applicable period is from 1st July of the previous year to 30th June of the current year.

It can take up to 6 months depending on complexity of the claim.

Need Help with Your VAT Refund from Cyprus ?

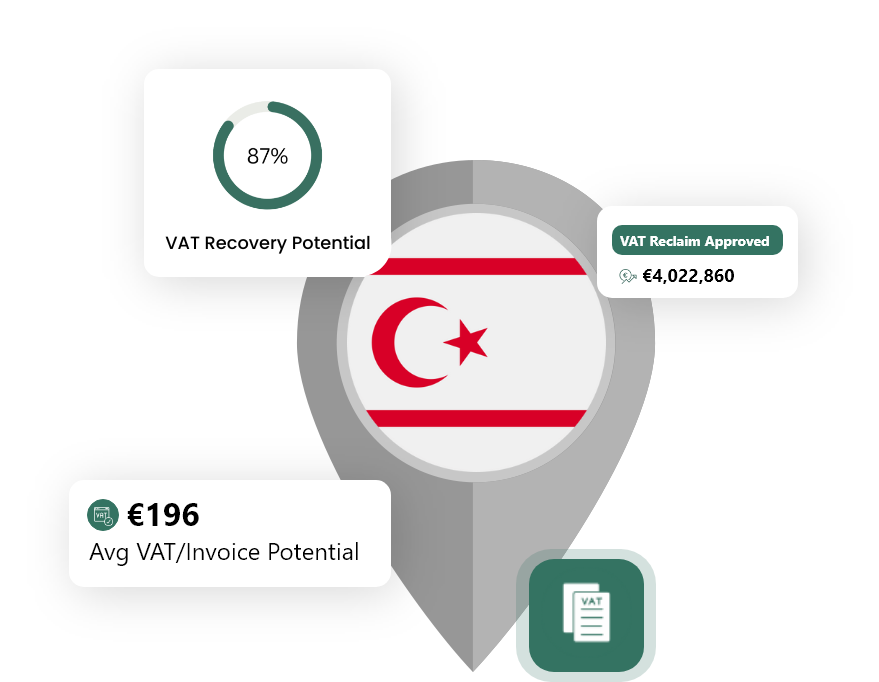

We have helped companies reclaim €200+ M in VAT refunds over the last eight years. Our expertise and technology allow us to process your refund quickly and automatically.