Foreign VAT Refunds Guide from Bulgaria

The following information details the requirements needed to be eligible for a VAT refund in Bulgaria. These include claimable expense types, the Austria VAT rates and deadlines, as well as claiming periods.

What Expenses are Claimable for VAT Refund in Bulgaria?

Hotel & Accommodation

10

%

Restaurants

10

%

Conf, Trade Shows & Expo

10

%

Public Transport

0

%

Fuel

10

%

Marketing Costs

10

%

Professional Fees

10

%

Car Rental

10

%

Training, Courses & Seminar

10

%

What are the Bulgaria VAT Rates?

Bulgaria divides VAT rates into the following three categories:

Applies to all goods and services.

This rate applies to specific goods and services, such as hotel stays and the supply of books

Some exports, international transport of goods and passengers, and related services

How to Get VAT Refunds from Bulgaria for Your Business?

VAT Refunds Guide for EU Companies

- Determine Eligibility: Check if your business and the expenses incurred are eligible for VAT refunds.

- Collect Documentation: Maintain original invoices for all business purchases.

- Submit an Electronic Application: Apply online using the e-VAT refund system in your home country. The refund claim application is then forwarded to the Bulgarian tax authorities.

- Monitor Your Application: Keep track of your application's progress through your home country's electronic VAT refund system.

- Await Refund: If your claim is approved, expect the refund to be processed within 4-8 months, depending on the verifications required.

VAT Refunds Guide for Non-EU Companies

- Determine Eligibility: Ensure your business and the eligible expenses qualify for a VAT refund and that there's a reciprocal agreement between Bulgaria and your country.

- Collect Documentation: Maintain original invoices for all business transactions.

- Submit a Paper Application: Apply by submitting a paper application directly to the Bulgarian tax authorities.

- Monitor Your Application: Follow the application's progress by staying in contact with the Bulgarian tax authorities.

- Await Refund: If your claim is approved, expect the refund to be processed within approximately 6 months.

Frequently Asked Questions About Bulgaria VAT Recovery

Companies established within the EU, including the Canary Islands and Monaco, have a deadline of 30 September. As for companies domiciled outside the EU, excluding the Canary Islands and Monaco, the deadline is 30 June.

All EU countries and Non-EU countries such as Canada, Japan, Iceland, Israel, Macedonia, Moldova, Norway, Republic of Korea, Serbia, Ukraine, Switzerland and the United Kingdom

January-December of the previous year.

VAT refunds are often processed within 6 months. However, the exact time may vary based on the complexity of the claim.

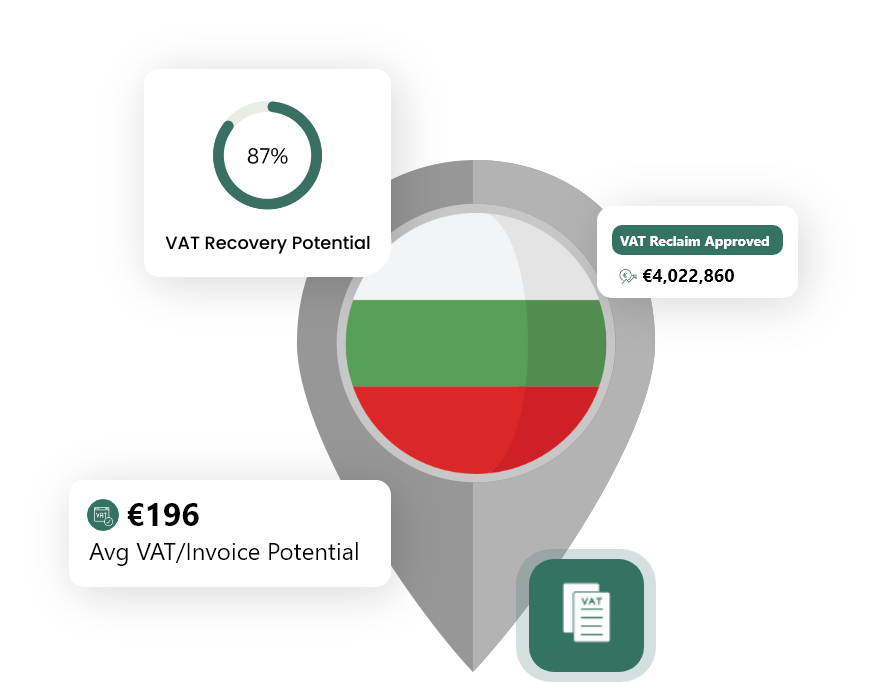

Need Help with Your VAT Refund from Bulgaria?

We have helped companies reclaim €200+ M in VAT refunds over the last eight years. Our expertise and technology allow us to process your refund quickly and automatically.