Foreign VAT Refunds Guide from Belgium

The following information details the requirements needed to be eligible for a VAT refund in Belgium. These include claimable expense types, the Belgium VAT rates and deadlines, as well as claiming periods.

What Expenses are Claimable for VAT Refund in Belgium?

Hotel & Accommodation

0

%

Restaurants

0

%

Conf, Trade Shows & Expo

10

%

Public Transport

0

%

Fuel

0

%

Marketing Costs

10

%

Professional Fees

10

%

Car Rental

10

%

Training, Courses & Seminar

10

%

What Expenses are Claimable for VAT Refund in Belgium?

Belgium divides VAT rates into the following three categories:

Applies to most goods and services.

- The reduced VAT rate of 6% applies to food products, books, pharmaceutical products and hotel accommodation.

- The reduced VAT rate of 12% applies to restaurant services and renovation/repair of private homes.

- Belgium does have a zero VAT rate on some goods. Although no VAT is charged on these zero-rated goods, their sale must still be reported on your VAT return.

How to Get VAT Refunds from Belgium for Your Business?

VAT Refunds Guide for EU Companies

- Ensure your business has a valid VAT number in your home state.

- Keep all original invoices for your purchases.

- Ensure VAT has been charged on these invoices and they meet Belgium's VAT invoice requirements.

- Submit a refund application via the Electronic VAT Refund (EVR) system in your home country before September 30th of the calendar year following the refund period.

- VAT refunds from Belgium usually take 4 months from the date of application.

VAT Refunds Guide for Non-EU Companies

- Ensure your country has a reciprocity agreement with Belgium.

- Keep all original invoices for your purchases.

- Ensure VAT has been charged on these invoices and they meet Belgium's VAT invoice requirements.

- Appoint a tax representative who is established in Belgium.

- Submit your refund application in paper format, including all original invoices, to the Belgian tax authorities before the June 30 deadline - This applies for the calendar year following the refund period.

- VAT refunds from Belgium typically take 6 months from the date of application.

Frequently Asked Questions About Austria VAT Recovery

September 30 for all countries.

All countries.

January-December of the previous year.

It can take up to 5 months depending on complexity of the claim.

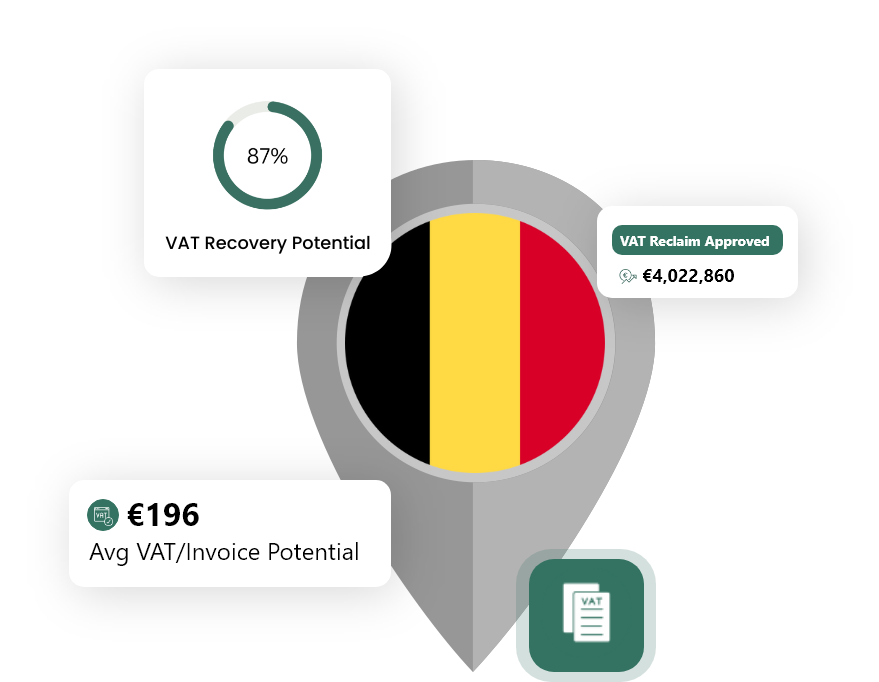

Need Help with Your VAT Refund from Belgium?

We have helped companies reclaim €200+ M in VAT refunds over the last eight years. Our expertise and technology allow us to process your refund quickly and automatically.