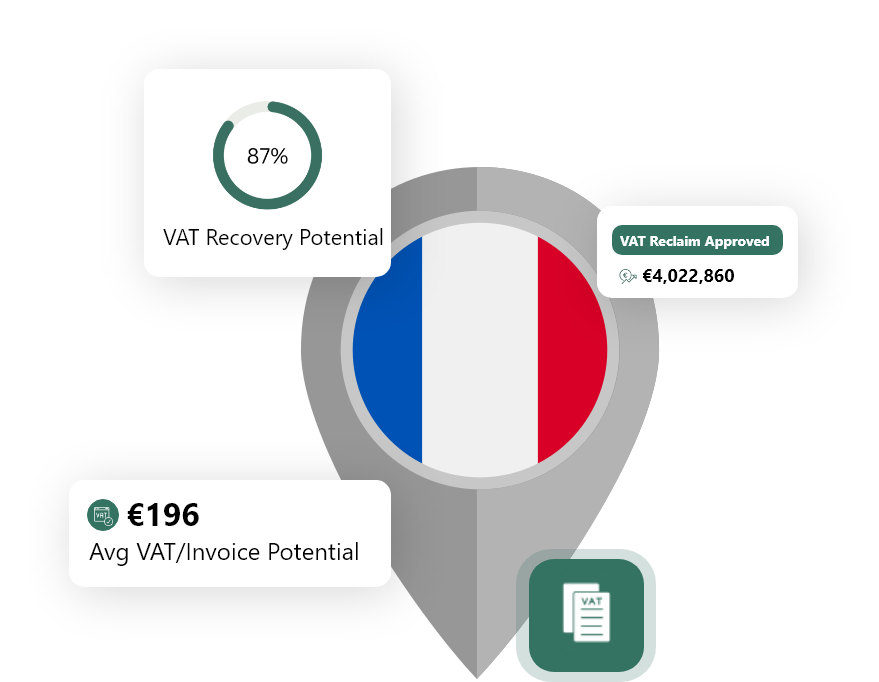

Foreign VAT Refunds Guide from France

The following information details the requirements needed to be eligible for a VAT refund in France. These include claimable expense types, the France VAT rates and deadlines, as well as claiming periods.

What Expenses are Claimable for VAT Refund in France?

Hotel & Accommodation

0

%

Restaurants

0

%

Conf, Trade Shows & Expo

10

%

Public Transport

0

%

Fuel

10

%

Marketing Costs

10

%

Professional Fees

0

%

Car Rental

0

%

Training, Courses & Seminar

10

%

What are the France VAT Rates?

Finland divides VAT rates into the following three categories:

Applies to mostly all goods and services.

• The reduced VAT rate of 10% applies to certain goods and services such as pharmaceutical products, books, newspapers, and admission to certain cultural events

• The reduced VAT rate of 5.5% applies to goods and services such as food products, energy-saving equipment, and renovation work on private dwellings.

• The reduced VAT rate of 2.1% applies to certain goods and services such as medical equipment and some agricultural products.

Applies to exports of goods and certain financial services

How to Get VAT Refunds from France for Your Business?

VAT Refunds Guide for EU Companies

- Register for VAT in your home country

- Provide evidence of your VAT registration to the French tax authorities (Direction Générale des Finances Publiques)

- Submit a VAT refund claim to the tax authorities of your home country

- Include all required documentation, such as original invoices and receipts

- Wait for your home country's tax authorities to process your claim and issue a refund

VAT Refunds Guide for Non-EU Companies

- Non-EU businesses must appoint a fiscal representative in France to handle their VAT refund claims

- Register for VAT in France through your fiscal representative

- Provide evidence of your VAT registration to the French tax authorities (Direction Générale des Finances Publiques)

- Submit a VAT refund claim to the French tax authorities through your fiscal representative

- Include all required documentation, such as original invoices and receipts

- Wait for the French tax authorities to process your claim and issue a refund

Frequently Asked Questions About France VAT Recovery

June 30 annually, within six months of the conclusion calendar year in which the tax was incurred

All countries.

January-December of the previous year.

It can take up to 4 months for businesses to get a VAT refund to be processed by the France Tax Authority depending on the complexity of the claim.

Need Help with Your VAT Refund from France?

We have helped companies reclaim €200+ M in VAT refunds over the last eight years. Our expertise and technology allow us to process your refund quickly and automatically.