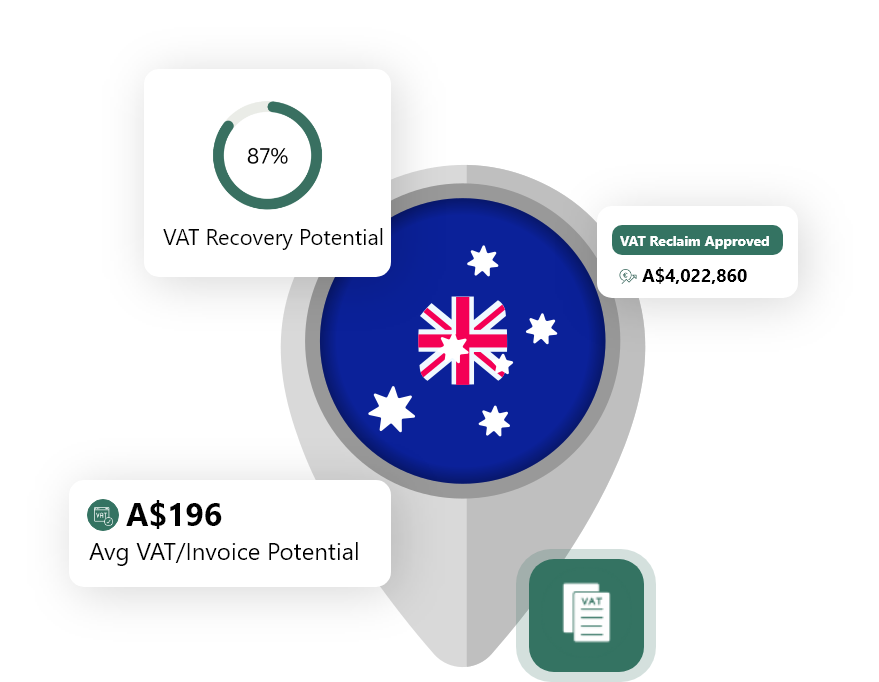

Foreign VAT Refunds Guide from Australia

The following information details the requirements needed to be eligible for a VAT refund in Australia. These include claimable expense types, the Australia VAT rates and deadlines, as well as claiming periods.

What Expenses are Claimable for VAT Refund in Australia?

Hotel & Accommodation

0

%

Restaurants

0

%

Conf, Trade Shows & Expo

0

%

Public Transport

0

%

Fuel

0

%

Marketing Costs

0

%

Professional Fees

0

%

Car Rental

0

%

Training, Courses & Seminar

0

%

What are the Australia VAT Rates?

The Australia divides VAT rates into the following three categories.

Applies to mostly all goods and services with few exceptions such as basic foods, certain medical and healthcare services, and some educational courses.

How to Get VAT Refunds from Australia for Your Business?

VAT Refunds Guide for EU Companies

- Register for the VAT Mini One Stop Shop (MOSS) online service in your home country

- Provide evidence of your VAT registration to the Australian Taxation Office (ATO)

- Submit a VAT refund claim to the ATO

- Include all required documentation, such as original invoices and receipts

- HMRC will review your claim and may request additional information if necessary.

- Wait for the ATO to process your claim and issue a refund

VAT Refunds Guide for Non-EU Companies

- Register for an Australian Business Number (ABN)

- Provide evidence of your ABN registration to the ATO

- Submit a VAT refund claim to the ATO

- Include all required documentation, such as original invoices and receipts

- Wait for the ATO to process your claim and issue a refund

Frequently Asked Questions About Australia VAT Recovery

Two years after the end of the calendar year in which the expense was incurred.

New Zealand, South Korea, Japan and Taiwan

Up to four years prior to the date of the refund claim.

It typically takes around 4-8 weeks to receive a VAT refund but may extend due to the complexity of the claim.

Need Help with Your VAT Refund from Australia?

We have helped companies reclaim €200+ M in VAT refunds over the last eight years. Our expertise and technology allow us to process your refund quickly and automatically.